East Java’s Economic Potential and the Vital Role of Regional Development Banks (BPD).

Date: 13 march 2025Categories :

By Sunarsip Chief Economist, The Indonesia Economic Intelligence (IEI)

Surabaya, March 13, 2025. East Java Province (Jatim) has a significant influence on the national economy. This is considering that East Java's Regional Domestic Product (GRDP) contribution to the national economy is very substantial, at 14.82 percent—the second-largest Gross Domestic Product (GDP) nationally after DKI Jakarta. East Java's GRDP contribution to the national GDP has the potential to increase, given that the space for economic growth in East Java remains wide open. Why is this so?

First, industrialization in East Java continues to develop. This is indicated by the contribution of the Manufacturing Sector in East Java. Currently, the Manufacturing Sector's contribution reaches nearly 31 percent of East Java's GRDP, an increase of almost 2 percent compared to 15 years ago. On the other hand, with regional capacity supported by sufficient resources (both natural resources and human resources), industrialization in East Java still has opportunities to develop, among others, through the downstreaming of natural resources based on agriculture, marine, and minerals.

Second, the characteristics of industrialization in East Java are relatively different from other regions that started their industrialization earlier, such as Jakarta, West Java, and Banten. Industrialization in Jakarta has entered a "sunset" period because the Manufacturing Sector's contribution to Jakarta's GRDP has greatly diminished. Meanwhile, if we observe, the symptoms of national de-industrialization over the last 20 years have actually largely affected industries in West Java and Banten.

West Java and Banten were the regions where industrialization in Indonesia first began. The industries that developed were import substitutions and had a high dependency on imported raw materials. At the start of their development, these industries received many facilities and incentives from the government. However, once various facilities and incentives were revoked in the early 2000s, followed by a trend of Rupiah weakening, their resilience decreased. And now, we can witness many of them closing their factories in Indonesia.

In contrast, the industrial structure in East Java is more dominated by manufacturers of consumer goods, such as food and beverages, which rely on local raw materials (both from East Java and other regions). This also includes other industries such as wood processing, non-metallic minerals, basic metals, as well as chemical and pharmaceutical industries. With these characteristics, manufacturing in East Java has relatively stronger resilience against external shocks. Additionally, the export market for East Java's manufactured products is also largely marketed to Asia. This makes manufacturing performance in East Java relatively solid, thereby strengthening its role in East Java's GRDP.

Although the contribution of the Agriculture sector to East Java's GRDP is on a downward trend, its role remains vital as a buffer for food needs and raw material requirements for the Manufacturing Sector in East Java and nationally. Currently, the Agriculture sector's contribution to East Java's GRDP reaches 10.66 percent (2024). East Java is one of the largest national food barns, produced by food crops, fisheries, and livestock. Besides being used to meet food needs in East Java, East Java's agricultural products are also exported to other regions such as DKI Jakarta and outside Java.

In addition to the Manufacturing and Agriculture sectors, East Java's economy is also supported by the role of the Trade sector. Currently, the Trade sector's contribution to East Java's GRDP reaches 18.81 percent (2024). The high contribution of the Trade sector is supported, among other things, by the high business potential that can be developed through trade routes (domestic and foreign) along with the solid performance of the Manufacturing and Agriculture sectors.

Along with the solid performance of these three main sectors, construction needs in East Java have also increased. Construction is needed for, among other things, connectivity infrastructure, agricultural infrastructure, housing, industrial and trade areas, tourism, and others. Thus, it is not surprising that the Construction sector's contribution to East Java's GRDP is maintained at a relatively high level, around 9 percent in 2024.

The Role of Regional Banks

As mentioned above, East Java Province has room to grow with an increasingly large contribution from the Manufacturing sector. This potential is supported by several advantages possessed by East Java. First, East Java has many strategic locations that can be developed into integrated industrial parks, both for processing natural resources from East Java itself and from outside East Java. Second, supporting infrastructure such as the connected Trans-Java toll road, adequate energy and water infrastructure, land transportation such as railways, warehousing facilities, ports, and airports.

Third, access to large availability of funding. All major financial institutions are present in East Java. In addition, support from financial institutions owned by the East Java provincial government, such as Bank Jatim Tbk, also completes the support in providing financing for industrialization and export-import transactions. Fourth, the availability of adequate skilled labor. Fifth, support from strong research and innovation centers. East Java has many universities with research and innovation reputations recognized internationally. Additionally, East Java also has several strategic industries and State-Owned Enterprises (BUMN) that can become partners for the development of innovation and manufactured products.

Sixth, besides manufactured products being marketable through exports, East Java itself is a large market. East Java has the second-largest population in Indonesia. Manufactured products in East Java can also be marketed to other regions. Seventh, large input (raw material) support. East Java's largest agricultural yields can be utilized as input for various agro-industrial products. With the support of complete infrastructure and transportation routes, East Java can also access sources of raw materials from outside East Java, which will certainly also provide a multiplier effect for those regions.

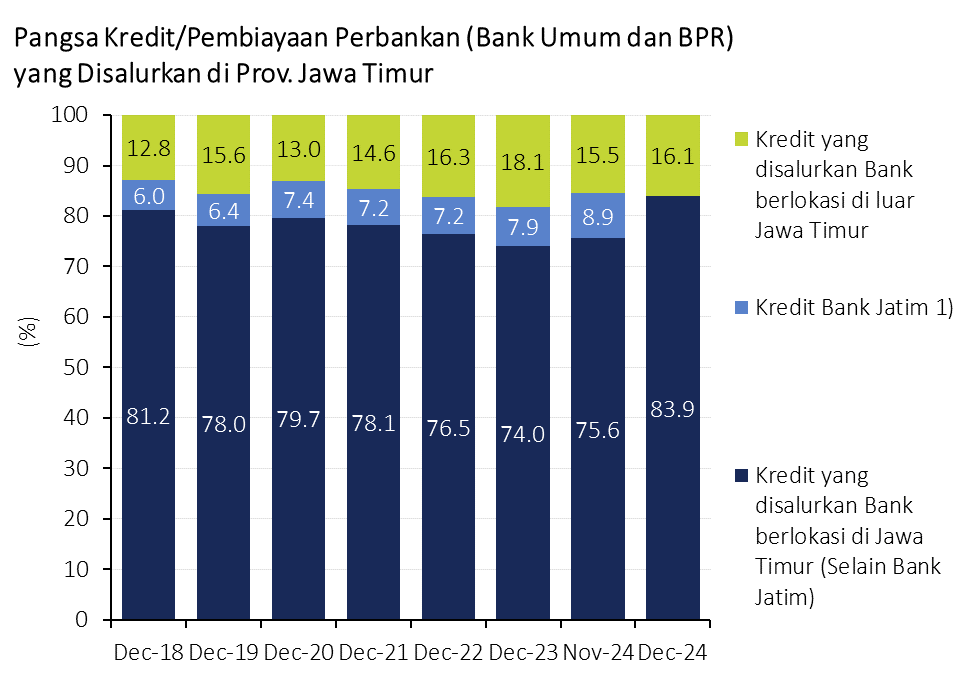

Given the immense potential for economic development in East Java, the involvement of financial institutions (in this case, banking) is vital to support the achievement of East Java's economic progress. So far, financing needs for business activities in East Java are met not only by banks located in East Java but also by banks located outside East Java. Based on data from Bank Indonesia, out of the total credit/financing in East Java amounting to IDR 732.5 trillion as of December 2024, IDR 614.7 trillion (or approximately 83.9 percent) was met by banks located in East Java. The remainder, IDR 117.8 trillion (or about 16.1 percent), was met by banks located outside East Java. This shows that in the eyes of national banking, East Java has great potential to be developed.

Regional Banks, in this case, banks owned by the regional government (Pemda), also show an ever-growing role in business financing activities in East Java. The credit/financing contribution of Bank Jatim Tbk to the total credit distributed by banks in East Java is relatively large. As of November 2024, Bank Jatim Tbk's credit contribution reached 8.9 percent of the total banking credit distributed in East Java. Bank Jatim Tbk's contribution or credit share has increased every year, where in 2018 it only reached 6.0 percent of the total banking credit distributed in East Java (see Figure).

The increase in Bank Jatim Tbk's credit contribution is driven by its relatively high credit growth. In December 2024, credit growth in East Java reached 5.45 percent (year-on-year, yoy). Meanwhile, in January 2025, Bank Jatim Tbk's credit grew by 18.06 percent, far above the average industrial credit growth in East Java. This high credit growth is also supported by a relatively favorable funding composition.

On the funding side, Bank Jatim Tbk controlled 11.30 percent of third-party funds (DPK) in the East Java banking sector as of November 2024. Bank Jatim Tbk's DPK contribution or market share has increased annually, rising from 9.0 percent of total banking DPK in East Java in 2018. Beyond its large market share, Bank Jatim Tbk's funding composition is also healthy. The majority of DPK obtained by Bank Jatim Tbk—specifically 54.6 percent—consists of low-cost funds from both current accounts (Giro) and savings accounts (Tabungan).

The author observes a strong correlation between East Java's economic potential and development and Bank Jatim Tbk's performance. Bank Jatim Tbk's business focus on the retail, micro, small, and medium enterprise (MSME) segment is strongly linked to the commitment of all local governments (Provincial and Regency/City) in East Java. However, East Java also possesses great potential for the growth of large businesses or corporations, both in manufacturing-related sectors and other supporting industries. Therefore, Bank Jatim Tbk must capture these opportunities while simultaneously strengthening its role and positioning within the East Java banking industry. Strengthening capacity and capabilities in funding and financing related to these new business potentials must also be well-prepared.

In conclusion, East Java has the potential to become an economic growth hub in Indonesia, particularly in manufacturing. Besides being an agro-industrial manufacturing hub, East Java also has potential as a manufacturing hub for other natural resources that are the strengths of other regions. If this potential is optimized, East Java could gain significant value-added from this industrialization. This value-added includes increases in GRDP, employment, regional income, and the development of MSMEs. Furthermore, East Java has the potential to become the largest industrial center in Indonesia, potentially displacing West Java, which is currently affected by de-industrialization.

PT BANK PEMBANGUNAN DEERAH JAWA TIMUR Tbk Jl. Basuki Rahmat 98-104 Surabaya

E:

T: (031) 5310090-99 ext 471

F: (031) 5310838